Financial debt can be a hefty worry that can evaluate you down and maintain you from attaining your monetary goals. If you find yourself fighting with multiple bank card expenses and high-interest prices, it may be time to consider bank card debt consolidation fundings.

What are Bank Card Combination Loans?

Charge card loan consolidation fundings are a sort of funding that aids you pay off several bank card debts by consolidating them right into one monthly settlement. The funding is generally obtained at a lower rates of interest than your present bank card financial obligations, which can conserve you money in the future.

Advantages of Credit Card Combination Finances:

Streamline Your Finances: By combining your charge card financial obligations into one month-to-month payment, you can streamline your finances as well as keep an eye on your financial obligations much more conveniently.

Lower Interest Rates: Charge card debt consolidation finances usually come with lower interest rates than credit cards, which can help you conserve cash on passion settlements.

Enhance Credit History: Making prompt repayments on a charge card combination lending can aid enhance your credit rating and also demonstrate to lenders that you are a liable customer.

How to Select the Best Bank Card Consolidation Car Loan:

Contrast Rates Of Interest: When picking a bank card consolidation finance, contrast interest rates from various lenders to locate the best price for you.

Check for Hidden Charges: Some lending institutions may charge concealed charges for charge card debt consolidation financings, so make sure to review the small print and comprehend the overall expense of the funding.

Think About Payment Terms: Think About the payment terms of the lending and choose a loan that fits your budget and also timeline for repaying financial obligation.

Final thought:

In the next part of this article, we will certainly review exactly how to get a charge card combination lending, suggestions for successful financial obligation combination, and also various other sources for leaving financial debt in 2023.

How to Make an application for a Charge Card Debt Consolidation Car Loan:

Gather Details: Before requesting a bank card debt consolidation car loan, collect info about your financial debts, including the quantity owed, rate of interest, and minimum monthly repayments.

Check Your Credit Report: Check your credit report to see if you are eligible for a bank card combination loan as well as to understand what rate of interest you might get approved for.

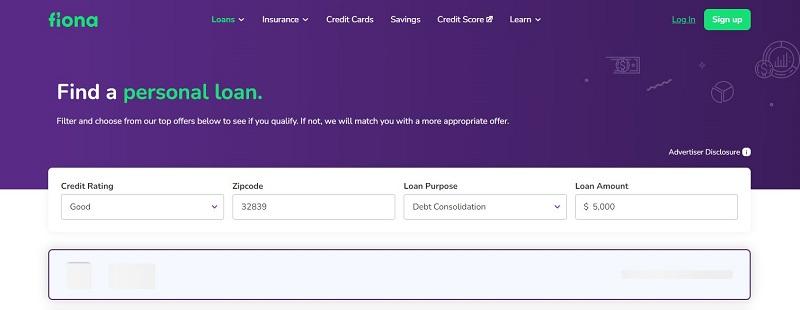

Pick a Lender: Pick a lender that uses the best rate of interest as well as repayment terms for your requirements.

Submit an Application: Send an application to the loan provider, offering all required details, including evidence of earnings and a checklist get more info of financial obligations you wish to combine.

Testimonial and Sign the Finance Agreement: Evaluation the finance agreement thoroughly before finalizing and also make sure you understand the terms of the financing.

Tips for Successful Debt Debt Consolidation:

Adhere to a Spending plan: To ensure success with credit card combination, it is very important to adhere to a spending plan and also stay clear of taking on new debt.

Make Timely Payments: Make timely payments on your credit card combination funding to enhance your credit history as well as avoid late charges.

Pay Greater Than the Minimum: Paying more than the minimal monthly repayment can aid you pay off debt quicker and also conserve money on rate of interest.

Various Other Resources for Leaving Financial obligation in 2023:

Financial Obligation Administration Plans: If you are unable to safeguard a bank card debt consolidation finance, a financial obligation administration plan may be a sensible alternative. Financial obligation administration plans entail collaborating with a monetary professional to pay and create a spending plan off financial obligation in time.

Debt Therapy Solutions: Debt therapy services can aid you recognize your monetary situation as well as offer sources as well as strategies for leaving debt.

Conclusion:

Finally, bank card combination fundings can be a effective device for leaving financial debt and also enhancing your economic scenario. By picking the best car loan, staying with a spending plan, and also making use of various other sources, you can leave debt in 2023 and achieve your financial goals.

Comments on “Eliminate Debts and Reach Your Financial Dreams with Credit Card Consolidation Loans”